Download full paper from below link:

Blog Archives

UK participation in Islamic Finance bodies would better represent interests of UK Islamic Finance

The City of London is an important player in the Global Islamic Finance arena, but a lack of representation on global Islamic Finance institutions is leading to UK Islamic Finance losing out against global peers.

London is a leading Islamic Finance Centre

When Prime Minister Cameron announced in October 2013 a push to make London the Western Hub of Islamic Finance, he would have known that London is already a leading centre for Islamic Finance. It leads globally in the provision of short-term liquidity for Islamic Institutions through commodity Murabahah trades at the London Metals Exchange, a massive market which eclipses all other areas in Islamic Finance. London also plays a major role in Wealth and Asset Management for international Muslim clients, as well as in Islamic Banking where the UK has five wholly Sharia compliant Banks.

Progress is also being made on the Sukuk front with the long anticipated sovereign UK Sukuk to be issued towards the end of this year, whilst the London Stock Exchange enjoys a leading position, (but now somewhat challenged) position as a Sukuk listing venue. Additionally the dominance of English Law in most Islamic Finance contracts, as well as the dominance of British Banks in HSBC and Standard Chartered as the leading players in the Islamic Debt Capital markets is often overlooked.

Lack of UK membership of Islamic Finance bodies

One area in which the UK does not perform so well is in representation within global Islamic Finance bodies, and this lack of representation is damaging UK Islamic Finance. A case in point is the short-term Sukuk issuance programs announced by the International Islamic Liquidity Management Corp (IILM) and the Islamic Development Bank (IDB). Both programmes are denominated in US Dollars with no issuance in British Pounds (GBP).

This lack of GBP short-term liquidity puts UK Islamic Finance institutions at a double disadvantage against conventional as well as peer Islamic Finance institutions.

The conventional disadvantage is illustrated through a lack of short-term liquidity (over-night funds placement) which forces institutions to hold large amounts of cash, or cash like instruments which earn nothing in contrast to conventional banks which can place overnight cash into yielding places. Blake Goud provides an excellent real world example in his blog using Al Baraka Banking Group. The good news is that as stated, the IILM and the IDB are working to fix these short-term liquidity challenges.

The disadvantage of UK Islamic Finance against Islamic Finance peers, say in the Middle East or Asia is that these peers currencies will be closely or loosely fixed against the US Dollar and therefore they will happily snap up the short-term IILM or IDB paper. Due to short-term currency risk, UK Islamic institutions will likely need to assess market risk before entering into over-night GBP to USD trades in order to hold the short-term paper overnight (this currency risk would still have been true if a short-term commodity Murabahah trade had occurred as commodities are also priced in USD).

UK Islamic Finance needs better global representation

Joining global Islamic Finance institutions will give UK Islamic Finance a voice and role to represent its interests. Only last month The Central Bank of Korea became the 59th regulatory body to join the Islamic Financial Services Board (IFSB). UK membership of IILM should be a formality given that Luxembourg was a founding member (Luxembourg Central Bank is also a member of IFSB), whilst membership of the IDB would be somewhat challenging, not only for political reasons in UK, but for the reason that IDB membership would require UK membership of the Organisation of Islamic Conference (OIC), though given that Russia and Thailand enjoy observer status of the OIC and that the UK already has in place agreements with the OIC, the challenge may not be that insurmountable.

Delay in UK Sukuk may make it more attractive for GCC and South East Asian Investors

U.S. Dollar investors are thinking twice about subscribing to the United Kingdom’s debut Sovereign Sukuk due to the U.K. Pound’s (Sterling) soaring value, one Gulf-based Islamic banker said, but the deal is still likely to be heavily oversubscribed with the likelihood of it being upsized.

With the Sukuk to be denominated in Sterling, the case of Sterling strength is illustrative of the challenges London faces as it seeks to be the Western hub of Islamic Finance; that of the excess liquidity London seeks to tap is strongest in the energy exporting U.S. Dollar linked markets of the Gulf Cooperation Council (GCC) and Malaysia. Negative movements in currency valuations for the U.S. Dollar against Sterling will make U.K. based investment decisions unattractive for such U.S. Dollar based investors.

Whilst in the short-term Sterling does seem to be overbought against the Dollar, it is widely expected Dollar strength will emerge towards the end of 2014 thereby making subscription to the Sukuk (likely to be issued around October 2014) more attractive to GCC and South East Asian subscribers, hence the delay in the Sukuk issuance may be a blessing.

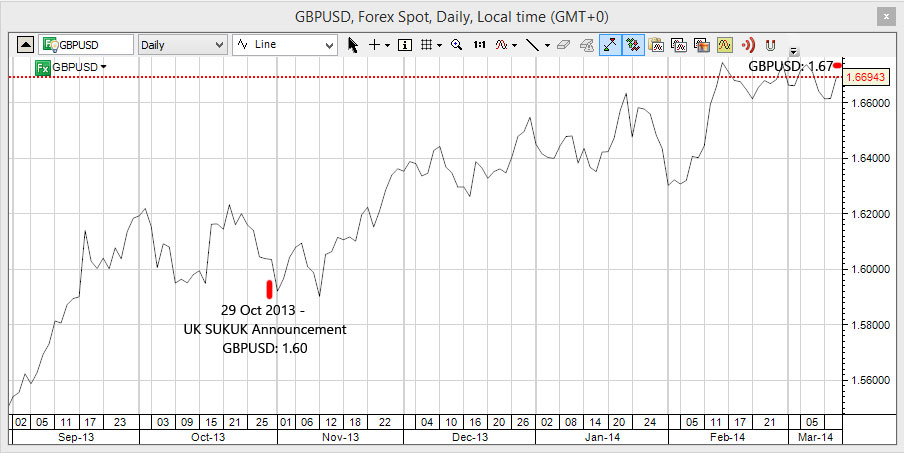

UK debut Sovereign Sukuk announced on 29 October 2013

Since the announcement of the intended issuance of the debut UK Sovereign Sukuk by Prime Minister David Cameron at the end of October 2013, Sterling has surged in value trading last week at yearly highs of over 1.68 against the US Dollar, up from 1.59 at the time of the announcement and seen in a slightly wider context up from 1.55 just a month prior to the announcement.

Whilst this near 8% rise may be welcomed in some quarters from a macro UK economy perspective (lower fuel costs leading to lower inflation), it makes U.S. Dollar based investors think twice about subscribing to the UK Sovereign Sukuk, for whom subscription to the primary offering costs around 8% more than it would have done in September 2013. This 8% hit is made more stark when we assume a maturity of 5 years for the Sukuk, in which case it will likely yield a similar lowly amount to conventional Gilt’s at around 1.97%.

Whilst the UK Sovereign Sukuk is aimed at domestic consumption from a growing domestic Islamic Finance services industry, seen from a wider context the secondary aim of the issuance would have been to attract demand internationally and whilst some interest has been expressed publicly, the strong Pound will dampen interest from the key GCC and South East Asian markets, all of whom are tightly linked to the US Dollar, either in terms of a fixed exchange rate, or a managed float against the basket of currencies of which the US Dollar would be the core component.

Chart showing Sterling’s soaring value against the U.S. Dollar.

Despite this, strong domestic Sterling demand will ensure the UK Sukuk will be heavily oversubscribed, and indeed similar to Turkeys Sukuk debut, there is a likelihood the deal maybe upsized as demand will greatly outstrip supply.

Islamic Development Bank Investor Presentation, Feb 2014

Presentation given by Islamic Development Bank (IDB) in February 2014.

Page 22 presents the key terms as well as structural overview of IDB’s $10 billion Sukuk MTN Programme. The Appendix from page 27 presents some of the real world financing projects IDB has participated in which is good to see as after all Islamic Finance is about real projects benefiting real people for real economic activity.

Details of the IDB Sukuk covered by Sukuk.com are presented below:

Islamic Development 2014, 850m, 3.7120%

Islamic Development 2015, 500m , 1.7750%

Islamic Development 2016, 750m, 2.3500%

Islamic Development 2017, 800m, 1.3570%

Islamic Development 2018, 1 billion, 1.5350%

Islamic Development 2019, 1.5 billion , 1.8125%

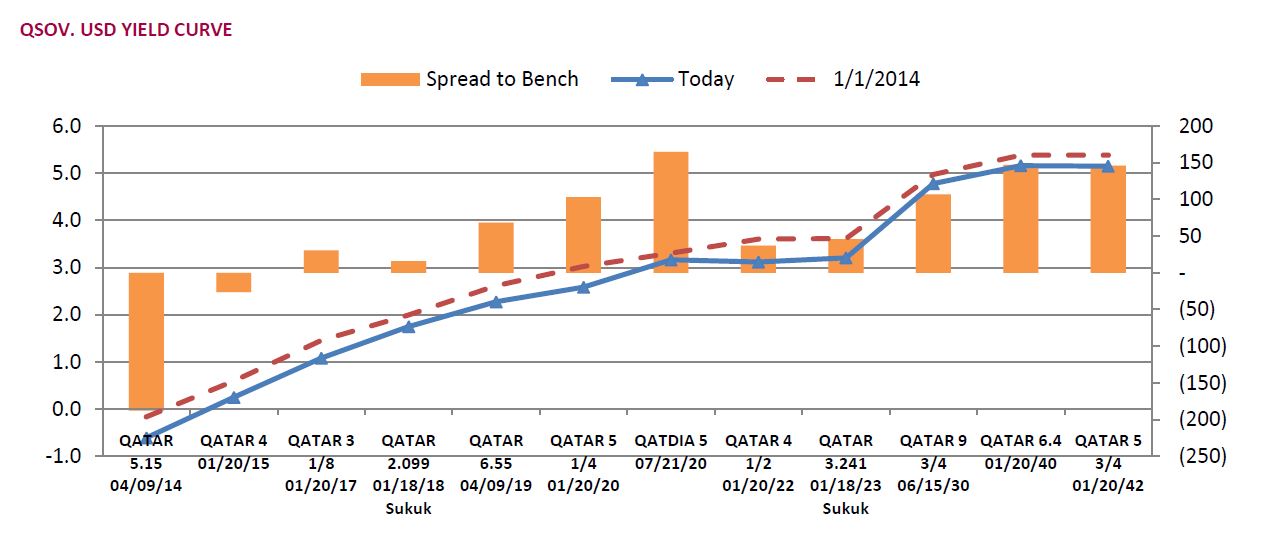

Chart showing integration of Qatar Sovereign USD Yield Curve of conventional and Sukuk

The below chart displays Qatar USD Debt yield curve showing the integration of conventional debt and Sukuk. Chart from Commercial Bank of Qatar.

Details of the Qatari Sovereign Sukuk covered by Sukuk.com can be found from the below links:

Qatar 2018, SoQ Sukuk A Q.S.C, USD$2B, 2.099%

Qatar 2023, SoQ Sukuk A Q.S.C, USD$2B, 3.241%

Qatar has not issued Sovereign Sukuk since July 2012, and has given no indication of any imminent return to the market.

UK Minister of State to promote UK Islamic Finance in Brunei

The Rt Hon Baroness Warsi will be promoting UK’s Islamic Finance to government departments, business and community organisations.

Baroness Warsi, Senior Minister of State at the Foreign and Commonwealth Office and Minister for Faith and Communities at the Department for Communities and Local Government is currently visiting Brunei. She will be meeting with a range of government departments and representatives of business and community organisations covering areas of mutual interest and promoting the UK’s Islamic finance initiatives.

Islamic finance is one of Baroness Warsi’s top priorities. At the World Islamic Economic Forum, WIEF held in London last October, at which His Majesty the Sultan of Brunei Darussalam consented to take part in a panel discussion with other Heads of State, Baroness Warsi said:

“It was 18 months ago, on a visit to Indonesia and Malaysia, that I was convinced of the potential for the growth of Islamic finance. I made it my personal priority.

“It’s why we set up the first ministerial-led Islamic finance task force, and it’s been a real pleasure to lead it. And from Malaysia to the Gulf, banging the drum for Britain, one thing came across loud and clear: The Muslim world wanted Britain to enter the capital market with an Islamic bond – a sukuk. And it wanted to see an Islamic finance market that never sleeps.

“Now there were many that said this can’t be done. But with pragmatism, political will, and downright Yorkshire stubbornness, I’m delighted that Britain has committed to becoming the first country outside the Muslim world to issue a sukuk.”

At the WIEF the UK Government committed to setting up a Global Islamic Finance and Investment Group, with the aim of identifying the key global opportunities and barriers facing Islamic Finance and to use its extensive knowledge and expertise to create a global Islamic Finance market that supports growth and prosperity. The Group, which had its inaugural meeting in London on 26 March, includes Premiers, Ministers, CEOs of major Islamic banks, central bank Governors and regulators – people who can make a real difference to the global landscape of Islamic Finance.

One of the inaugural members of the Group is Mr Javed Ahmad, Managing Director of Bank Islam Brunei Darussalam. We are delighted that Mr Ahmad was able to accept the invitation to participate, not only because of the expert knowledge and experience he brings to the Group but also because his participation helps strengthen further the links between the UK and Brunei in this area.

In March, Professor Dr Mehmet Asutay, Director of Durham Doctoral Training Centre in Islamic Finance, Durham University, was in Brunei to deliver the Islamic Financial Services Board Council Financial Policy and Stability public lecture on the topic of the “Islamic Moral Economy and Dynamics of the Development of Islamic Financial Services Industry”. The Autoriti Monetari Brunei Darusslam is the current Chair of the IFSB and hosted the 24th Meeting of the IFSB Council and 12th General Assembly as well as other related events.

The UK has been providing Islamic financial services for over 30 years and Government policy over the last decade has created a fiscal and regulatory framework that encourages the growth of Islamic finance. The UK is the leading western country and Europe’s premier centre for Islamic finance with US$19 billion of reported assets. The removal of double tax on Islamic mortgages, the extension of tax relief on Islamic mortgages to companies as well as to individuals, and the reform of arrangements for issues of debt have resulted in the UK becoming the key western gateway for Islamic finance with London as its World leading financial services centre.

Malaysia sold MYR1.5B Sukuk at 4.547% (average) as RAM reaffirms Malaysia’s gA2(pi) sovereign rating

Malaysia sold 1.5 billion ringgit of Sukuk maturing in 2028 at an average yield of 4.547%, Bank Negara Malaysia stated today. The bid-to-cover ratio was 2.77 times.

Separately RAM Ratings rating reaffirmed Malaysia’s gA2(pi) sovereign rating, citing a growing economy forecast to expand at 5.1% GDP (2013: 4.7%), though this was to be balanced by immediate fiscal concerns, in the form of the Government’s persistent fiscal deficit, sizeable debt burden and rising contingent liabilities.

($1 = 3.2475 Malaysian Ringgit)

East Cameron Gas Sukuk – a case study on sukuk default

East Cameron Partners (ECP) was the first US entity to issue sukuk through a two-tiered Musharakah structure. The issue was thought of as an advance in the US Islamic finance market where BSEC structured the deal, Merrill Lynch was the book-runner, KPMG were the auditors and the legal advisers were Vinson & Elkins LLP, Walkers and Baker Hostettler. In 2008, East Cameron filed for Chapter 11 bankruptcy protection under the US Bankruptcy Code.

Download and read full paper here: East-Camerron-Case-Study