History of Eurobond market points to Kuala Lumpur moving further ahead as the unrivalled major centre for Sukuk.

The lessons which Finance centres looking to establish themselves as Sukuk centres need to draw from London’s emergence as centre of the Eurobond market are liquidity, relationships and regulatory support.

How London emerged as Eurobond Capital

By the mid 1950’s, London because of its long established international banking relationships and the lack of control imposed on foreign dollar deposits was already established as the leading Eurodollar centre. London’s ascent into the leading Eurobond centre was the passing of the Interest Equalisation Tax of 1963 in the U.S. which made it less profitable for U.S. investors to invest abroad by taxing the purchase of foreign securities. This act led to issuers seeking to raise dollar capital in the form of Bonds away from New York to London in order to tap its vast dollar liquidity which for the most part was idle in deposit accounts. The move to London was given further impetus through restrictions placed on foreigners using the New York Bond market, as well as many European governments acting to repel dollar inflows, much to the further benefit of London.

The banks followed the issuers and London became home to the Eurobond market with the first Eurobond being issued in July 1963 by Italy’s Autostrade for $15m. By 1968 it was estimated that 60% of trading in Eurobonds was in London, totalling $15 million per day and handled by a growing number of foreign banks which by 1970 had more than doubled, with the number of U.S. banks increasing from 14 in 1964 to 50 by 1973.

On the investor side Eurobonds because they were bearer bonds issued outside the United States and not subject to tax were an ideal investment for institutions with large dollar deposits looking for yielding marketable securities. Eurobonds, because of the initial reluctance of the London Stock Exchange to allow them to list were often held until maturity and possessed little in the way of a secondary market. The secondary market developed in the 1960s as London banks once more drew upon their sophistication and relationships to trade Eurobonds amongst themselves using the telephone links already used for Foreign Exchange markets, for which London was and still remains the world’s leading market. As the market developed the London Stock Exchange became more welcoming and a natural home for Eurobonds and today is one of the world’s major centres for the issuing and listing of bonds.

We therefore see a sequence of events from excess dollar liquidity being centred in London, leading to the creation of a market which issuers tapped to raise capital, to the sophistication and relationships of London banks and its Stock Exchange being able to satisfy this demand as well as building a secondary market. If each of these points is mapped to the Sukuk market it is clear Kuala Lumpur is well positioned to move further ahead as the unrivalled major centre for Sukuk.

Sukuk Dollar Liquidity is in Kuala Lumpur

Over half a century after the issuance of the first Eurobond in London, much remains true today. The dollar remains the world’s reverse currency, the desire to hold funds and issue Bonds in dollars remains true, London remains the global centre for Foreign Exchange, and a place of dollar liquidity.

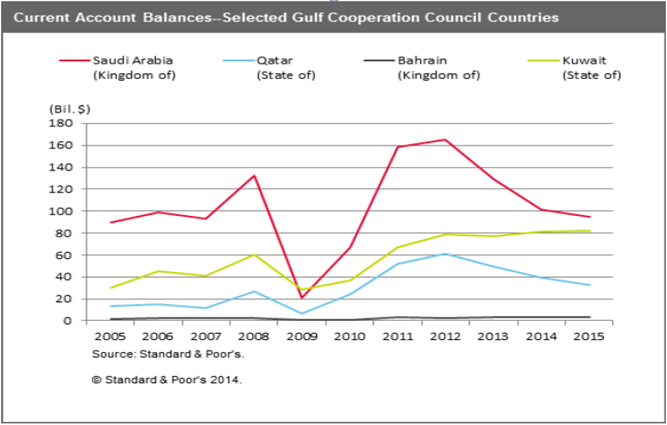

Building a market requires liquidity being centred in one place and in the context of Sukuk and its comparison to Eurobonds the type of liquidity sought to facilitate the investor side participation is not idle dollar deposits, rather surplus dollars from dollar linked energy exporting markets of the Gulf Cooperation Council (GCC), as well as other Organisation for Islamic Conference (OIC) countries. It is this dollar liquidity translating into Sukuk investors which is finding its home in Kuala Lumpur. This is not to say conventional (non-Islamic Bond investors) investors do not play a role in the growing Sukuk market, just that for Sukuk, conventional investors follow the market rather than lead it.

The below chart from Standard and Poors displays current account balances for some of the GCC countries, as well as projections for 2014 and 2015.

Kuala Lumpur is ahead of the curve

Just as London Banks were ahead of the curve in the 1960s for the Eurobond market; in the context of Islamic Finance and Sukuk, Kuala Lumpur is well ahead today.

Malaysia has been developing its Islamic Finance market for over 30 years since the passing of the Islamic Banking Act of 1983 and the establishment of the country’s first Islamic Bank, Bank Islam Malaysia. The Government of Malaysia issued its first Islamic government debt in the same year. The growth of Malaysia’s sukuk market is a result of years of building up infrastructure, including origination and listing that have resulted in the world’s largest and most active sukuk market being in Malaysia, accounting for 58.1% of total outstanding sukuk.

Kuala Lumpur is building the relationships

Just as international Banks opened up shop in London as the Eurobond market developed, so we have seen the Gulf Banks arrive in Kuala Lumpur with the likes of Al Rajhi Bank of Saudi Arabia (the world biggest Islamic Bank in terms of assets and balance sheet), Kuwait Finance House, and Qatar Islamic Bank arriving in Malaysia over recent years.

Similar to Italy’s Autostrade issuing the first Eurobond out of London in 1963, conventional international issuers who are non-Islamic, not based in Malaysia, and whose currency is not U.S. dollars have successfully tapped Malaysia’s liquid Sukuk market with the likes of Nomura Holding of Japan issuing a 2 year Sukuk for $100M in 2008, and more recently China based Noble Group tapping the market.

Much as London benefited in the 1960s as mainland European Finance centres sought to repel dollar inflows, so Kuala Lumpur benefits today as political spats emerge amongst GCC Sovereign’s, with each Sovereign going its own way to developing its Sukuk market domestically as opposed to collectively. For example Qatar and Saudi Arabia tend to issue in their local currencies, whilst the likes of Abu Dhabi and Kuwait have shown little recent interest in developing a Sukuk market. This lack of collective direction in the GCC is much to the detriment of Dubai and its financial centre.

Malaysia is busy deepening relationships and most recently the stock exchanges of Saudi Arabia and Malaysia signed an agreement to foster closer ties. These two countries holding a combined $682 billion in Islamic banking assets are the largest Islamic finance markets globally.

Looking beyond the Dollar

Malaysia’s ambitions are not limited to being a centre for surplus dollar liquidity, rather it is looking beyond the dollar Sukuk market.

In partnership with Hong Kong, Malaysia is developing its market as an offshore renminbi (RMB) and Islamic finance centre. The two economies are seeking to leverage their strengths in the development of the renminbi sukuk market. The Malaysian Sovereign Wealth Fund, Khazanah issued the first RMB Sukuk in 2011.

Furthermore the Malaysian currency, the Ringgit (MYR) is emerging as a currency of choice for sukuk issuance by non-Malaysian entities. In 2012, the amount issued in ringgit worldwide exceeded the amount issued by Malaysian issuers in all currencies. The Development Bank of Kazakhstan issued a MYR1.5 billion sukuk program in 2012, Abu Dhabi National Energy Co. PJSC, Bahrain-based Gulf Investment Corp., and National Bank of Abu Dhabi have also issued in MYR out of Malaysia.

As the Sukuk market develops, Malaysia’s success will be to the benefit of Dubai and London as the ripple effect of Sukuk growth spills over, with London in particular standing to benefit due to its time zone, deep pools of capital, and liquid markets providing market activity as Kuala Lumpur sleeps.

References:

The Global Securities Market: A History By Ranald Michie

Transaction tax supporters should recall the birth of the eurobond

Standard and Poors – After A Mixed 2013, The Global Sukuk Market Looks Brighter In 2014

Standard and Poors – Investor Appetite Is Pushing Sukuk Into The Mainstream, 2013

Asian Development Bank, Asia Bond Monitor March 2014