With over 2.6 trillion euros of assets under management this January, Luxembourg is the largest regulated funds domicile in Europe and the world’s cross-border distribution hub for investment funds with a market share of 75%.

But what about Islamic Finance? Is Luxembourg an emerging country in this field?

Geographically speaking, the market for sharia-compliant funds is concentrated within three main markets: Saudi Arabia, Malaysia and Luxembourg. According to Thomson Reuters’ Global Islamic Asset Management Report 2014, 2013 saw the highest number of funds launched and lowest number of closures. As a result, the number of mutual funds has doubled since 2007.

What makes Luxembourg so attractive?

Luxembourg’s well-known financial sector and its strength in conventional finance was a natural incentive for Islamic Finance to choose Luxembourg back in 1978. Unlike London, which is primarily known for its Islamic banks, Luxembourg does not focus on one single area but rather embraces all aspects of Islamic Finance: Banking, Asset Management as well as Insurance (Takaful). What’s more, Luxembourg has not chosen to limit itself by applying only one set of Sharia rules. Instead, it welcomes all of them, each with their own specificities.

As it stands today, Islamic finance is still a niche activity in Luxembourg. However, key figures in both the public and private sector see Sharia-compliant funds as a promising opportunity for growth: the infrastructure is in place and many new projects are in the pipeline. With its openness to innovation, the country has demonstrated an ever growing interest in Islamic Finance. Not only has a favourable environment been set up, but the government has also led by example in its initiative to issue a Sukuk. [1]

From niche to mainstream: how to reach the critical mass?

What are the key challenges?

There are a number of barriers to the growth of Islamic Finance in the EU:

- Perception and image: There is a common belief that Islamic Finance is only made for Muslims. In reality, this couldn’t be less true. The main principle is that – instead of making money with money – cash is considered as an exchange tool and not a commodity. In this way, Islamic finance products invest in real assets, using partnership agreements to support the risks and rewards. In contrast to conventional bonds, where returns are based on a fixed or variable rate, Sukuk returns are based on the performance of an underlying asset.

- Limited offering: there is currently only a small range of products on offer, in part due to difficulties finding the right projects to finance.

- Cost: unclear tax treatment and cost issues are hampering progress;

- Unclear legal and regulatory requirements: in principle, Islamic Finance products are subject to the existing laws and regulations we apply to conventional finance. However, the complexity of certain structures and products mean further analysis is required as existing regulation may be subject to interpretation.

The way forward

The Luxembourg State experienced some difficulties in launching Luxembourg’s first Sukuk. This makes for a good case study, highlighting a number of areas where further clarification will be required if EU countries are to boost the use or issue of Islamic finance products.

- Tax treatments: further clarifications are required for each and every Islamic Finance product. Although tax treatment for Sukuk [2] may now be crystal clear, there’s not yet such clarity for the underlying agreements within the structure. One solution might be found in the way that Luxembourg approached Sukuk. Here, the government looked for an existing product with similar principles and then applied the same tax treatment to the new product, Sukuk. This methodology could be applied more consistently, with each country performing an upfront review of existing products with a view to matching them up with their Islamic counterparts.

- Legal requirements: what does “Sharia compliant” mean in Luxembourg or in the EU?

Contrary to Malaysia, Saudi Arabia and other leading countries in the field of Islamic Finance, there is no such thing as a defined set of Sharia rules applicable in Luxembourg nor in the EU. It is to be noted that even in those countries who have reached greater maturity in the field of Islamic Finance, there are some differences in interpretation.

Should Luxembourg be the first mover in the adoption of certain Sharia rules in its own legislation or adopt its own set of standardized Sharia rules for plain vanilla products?

If so, the treatment of such rules would not be different from any other compliance matters and may eradicate the need to appoint Sharia boards. It is to be noted that a majority of Muslims currently invest in conventional finance as there are limited alternatives open to them.

- Investors: who can or should invest in Islamic Finance products? Islamic finance products are, when all’s said and done, still finance products and there is no reason to restrict them to Muslims only. Existing rules around conventional finance could still apply. One element to consider, however, is how to limit any expectation gap, by indicating the specific rules that the product is following in the offering document as long as no clear set of Sharia rules are embedded in national legislation.

- Costs: by clarifying both the legal environment and tax treatment of Islamic Finance products, part of the additional costs involved might be reduced.

Once these aspects are clarified, large conventional players may be encouraged to offer Sharia compliant versions of their current products, as they have the credibility and confidence to give the get-up-and-go as well as the client base. Positioning Islamic funds as socially responsible or ethical investments could be a key strategy for fund managers. SRI is a fast-growing subsector of the conventional funds industry, naturally aligned with Islamic funds.

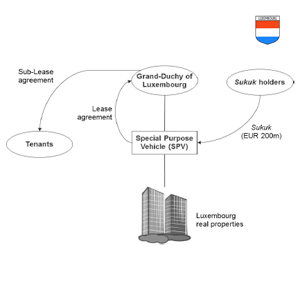

[1] The sovereign sukuk to be issued by Luxembourg will involve the sale and leaseback of assets (sukuk-al-ijara). Three buildings including the two towers situated at the Place de l’Europe in Kirchberg and the Gutenberg building in Strassen will be transferred to an SPV (a Luxembourg S.A. owned by the state of Luxembourg) that will issue EUR 200m of sukuk (corresponding to the value of the three properties).

[2] The tax treatment of Sukuk issued by a Luxembourg company has been clarified in a tax circular released on 12 January 2010 (Circular L.G.-A No. 55 of 12 January 2010). The circular confirms the classification of Sukuk as debt for Luxembourg tax purposes

Lutfije Aktan, KPMG Luxembourg

+352 22 51 51 6609