By Michael Bennett, Head of Derivatives and Structured Finance in the Treasury Department of the World Bank.

Surveying the available financing models in the Middle East for sustainable infrastructure projects, Sukuk appears as a viable option to match the region’s growth.

Three trends are discernible in the current global financial market:

1. Banks are reluctant to commit long-term capital to infrastructure finance due to stricter capital requirements;

2. An increasing number of investors are interested in environmentally sustainable investing, in other words, investing to promote activities that are seen as being positive for the environment;

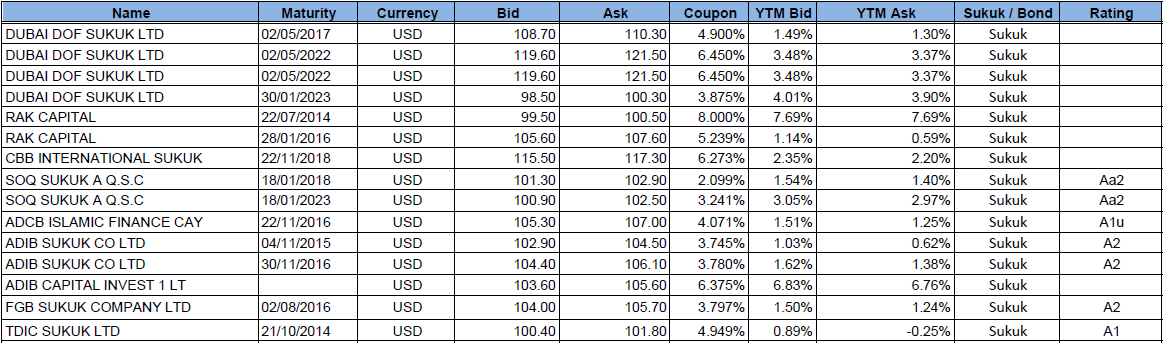

3. The market for sukuk, the Islamic financial instrument most similar to a conventional bond is growing significantly.

While these three trends are distinct and not obviously related, taken together, they create a market opportunity for sukuk to be used as a tool to finance environmentally sustainable infrastructure projects.

The need tor significant infrastructure spending is obvious in both developed as well as developing countries. From crumbling transportation infrastructure in the United States to inadequate power generation capacity in India, the evidence is clear that improving infrastructure is a global priority. At the same time, popular concern about climate change and the detrimental impact of increasing greenhouse gas emissions has made improving infrastructure in an environmentally sensitive manner a priority also.

Banks, the traditional providers of debt finance for infrastructure projects have been pulling back from this type of lending due to regulatory changes that have decreased bank appetites for longer dated risk. Capital markets investors are in theory, well-placed to replace banks as the providers of debt finance for infrastructure, given that many projects offer relatively high yields with low correlation with other types of fixed income instruments.

However debt financing of infrastructure projects would be an entirely new and unfamiliar asset class tor most capital markets investors. As a result, intermediaries will need to engage in considerable marketing efforts to interest capital markets investors in infrastructure and the investments will need to be packaged in a manner that appeals to such investors.

One potential means of attracting capital markets investors’ interest in infrastructure finance is to combine the two other trends described above — the expanding markets for both environmentally sustainable investing and sukuk. Although, to date these two markets have been geographically distinct – with environment-focused investors mainly found in Northern Europe, North America and Japan and sukuk investors concentrated primarily in the Persian Gulf and Malaysia — the two markets do share a strong commonality.

Both environmentally sustainable investors and sukuk investors aim to use their money in a manner that conforms to their values and beliefs. Whereas traditionally finance has been solely driven by the effort to maximise risk-adjusted returns, these types of investors have added an additional qualitative objective for financial market activity— compatibility with the investor’s ethics.

A sukuk in which the proceeds are used to fund a specific environmentally sustainable infrastructure project such as the construction of renewable energy generation facility, could appeal to both sukuk investors and conventional environment focused investors. Combining these two distinct investor bases would be a novel development for the capital markets.

While some conventional investors, mainly bank treasuries and hedge funds purchase sukuk, the vast majority of conventional investors [including virtually all environmentally sustainable investors] have no experience at all with these instruments. However, there is nothing intrinsic to sukuk that make them inappropriate for conventional investors. Although the structures and terminology will be unfamiliar at first sukuk should be attractive to conventional investors if they offer reasonable risk-adjusted returns and are properly marketed.

A sukuk that meets those criteria and provides funding for an environmentally sustainable project could be particularly attractive to environment-focused investors for two principal reasons. First, sukuk provide investors with a high degree of certainty that their money will be used for a specific purpose. In order to comply with the underlying Shari’ah principles, the funds raised through the issue of a sukuk must be applied to investment in identifiable assets or ventures. Therefore, if a sukuk is structured to provide funds for a specified infrastructure project, such as a renewable energy project, there is little chance the investors‘ money will be diverted and used for another purpose.

Second, many more environment-focused investment products exist on the equity side of the capital markets than on the fixed income side. The reason for this lack of supply is that the majority of corporate and sovereign bonds are general unsecured obligations of the issuer, meaning the use of the proceeds of the bonds is not restricted to a particular purpose. Since most environmentally sustainable investors want to know precisely how their money will be used, bonds that are general obligations of an issuer have limited appeal unless all of the activities of the issuer meet the investor’s environmental standards.

Sukuk, which are most similar to a conventional fixed income securitie could help fill the fixed income supply gap for environmental investors to the extent the proceeds of a sukuk are earmarked for a particular environmentally beneficial purpose.

ln the conventional capital markets, environment-focused bonds have begun to appear in recent years. The World Bank, for example has issued since 2008 a type of bonds called ‘World Bank Green Bonds’. Rather than funding all of the activities of the World Bank, the proceeds of World Bank Green Bonds only go to support certain projects that meet pre-determined criteria for low carbon development. These bonds have been very well-received by environmentally sustainable investors, and the structure has become a model for other supra-national, corporate and sub-sovereign issuers. “Green” sukuk have the potential to further broaden this market as well as to help to bridge the gap between the conventional and financial worlds.

ABOUT MICHAEL BENNETT

He is the Head of Derivatives and Structured Finance in the Treasury Department of the World Bank which includes responsibility for the World Bank’s transactional capital markets work in the area of Islamic finance. He is a graduate of Columbia University Law School in New York and has published numerous articles on financial topics including Islamic finance, structured products and derivatives regulation in Asia.

This article was originally published in the State of Energy Report, Dubai 2014 1st Edition, an initiative of the Supreme Council of Energy and co-sponsored by UNDP and Dubai Carbon.