The structure of Sukuk through the creation of Special Purpose Vehicles (SPVs) provides better transparency thereby reducing corruption and wastage as productive assets must be put to work in order to generate rental incomes for investors, rather than disappearing into offshore banking centres or participating in deliberately over priced projects.

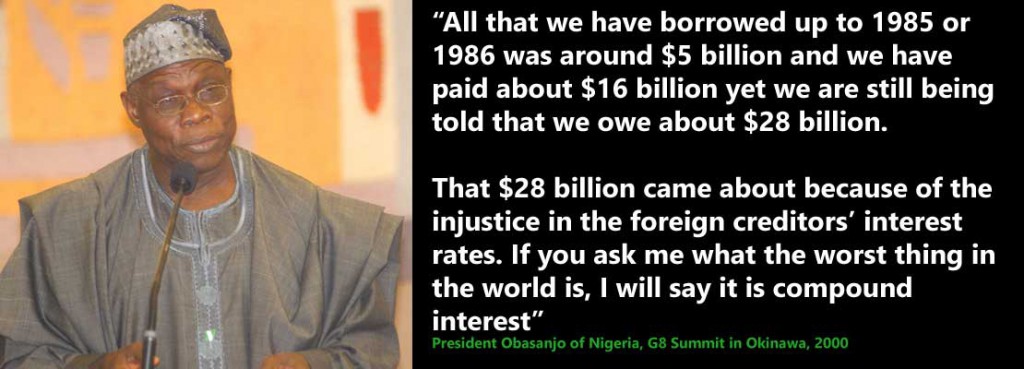

Corruption and abuse of state funds affects many countries and Organisation of Islamic Cooperation (OIC) countries are no exception. Corruption has a devastating impact for many reasons, one of which is whilst funds are siphoned off abroad, the debt remains on the countries balance sheet and accrues interest charges, compounding larger year after year.

In its annual report, Transparency International ranks countries based on expert opinions of public sector corruption. Countries scores can be helped by open government where the public can hold leaders to account, while a poor score is a sign of prevalent bribery, lack of punishment for corruption and public institutions that don’t respond to citizens needs.

The 2014 report makes interesting reading with Denmark, New Zealand and Finland ranked as the least corrupt countries and unfortunately a host of OIC countries coming out towards the wrong side of index, with the notable exception of the UAE and Qatar which rank 25 and 26 respectively, better than the likes of France, Portugal and Poland.

Sukuk Reduces Risk of Corruption and Theft of Funds

In addition to the traditional benefits of sukuk, such as diversifying an investor base and accessing investors who do not invest in interest based bonds, a less discussed value add of sukuk is its structure, particularly the Ijara structure which to a greater deal over conventional bonds prevents the wastage of funds through corruption and theft.

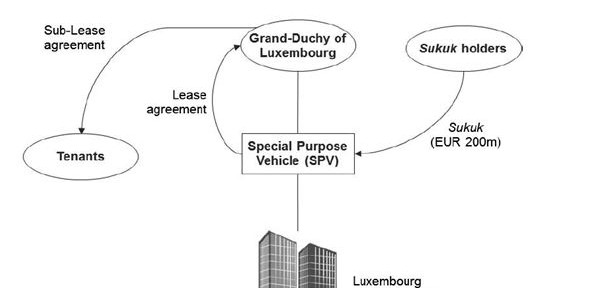

Taking the example of the sukuk issued by the Government of Luxembourg in 2014, three government properties – two towers of the Gate of Europe in Kirchberg and the Gutenberg building in Strassen were sold to a Luxembourg SPV for which the Luxembourg Government was the single shareholder.

The SPV was securitised by means of the sukuk holders investing €200 million who whilst receiving this value back at maturity (when the Government buys back the properties from the SPV), would receive a benchmark linked profit rate of 0.436% to be generated from the rental income received by the SPV from the tenants of the three properties securitised.

This asset linked profit generation means investors get to understand the underlying asset and are more involved in the project. All money raised has to be accounted for as it is used by the SPV to purchase the properties, the funds cannot go missing, or be wasted.

Transparency will Increase Investors Confidence to Fund Big Infrastructure Projects

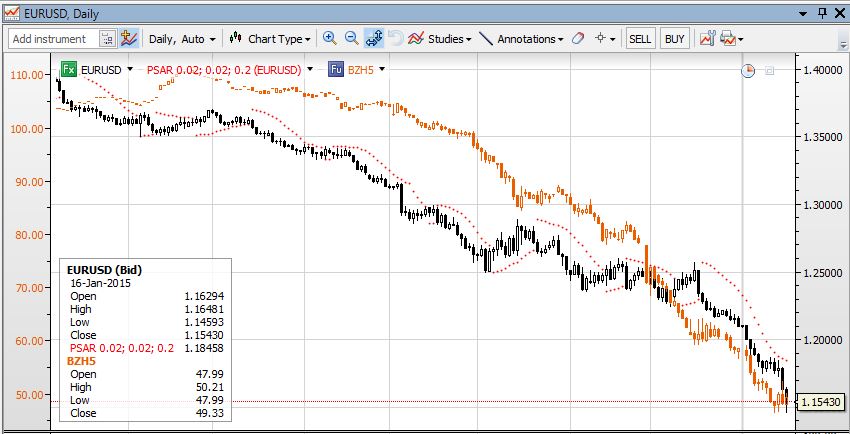

Increased transparency can be used to inspire investor confidence and trust thus leading to increased foreign direct investment (FDI). For countries which face the challenges of corruption as well as those seeking to avoid the injustices of interest based bond borrowing, sukuk represent an opportunity to tap a new investor base, one that is ethical and provides the borrower more rights and prevents abusive interest charges in case of default.

At a recent Islamic finance conference in Nigeria, Usman Hassan, CEO of Jaiz Bank, a Nigerian based Islamic Bank set up in 2003, urged the Nigerian government to take a closer look at sovereign sukuk issuances to fund infrastructure projects. He stated “Sukuk are very apt for Nigeria, as you cannot have failed projects…for every project you have, you are raising government money and it has to be accounted for, the financier (investor) will not allow abuse”. He urged to government to look at the structure of sukuk to see how it can be of benefit to the economy as a source of FDI from a new diverse investor base.