Decline in Sukuk listings at London Stock Exchange damages London Islamic Hub ambitions

As London strives to be a major Islamic Finance hub, the London Stock Exchange (LSE) should be one of the main drivers helping to build the critical mass needed to create a vibrant Islamic Finance market in London. Nasdaq Dubai is successfully doing so for Dubai and for many years, the LSE was doing so for London. The LSE’s recent performance however has been far from stellar with the neighbouring Irish Stock Exchange (ISE) taking LSE’s previously held crown as the venue of choice for international issuers listing Sukuk.

Listing Sukuk on Exchanges

The secondary market for Sukuk, as with conventional Bonds operates for the most part, as a decentralized over-the-counter (OTC) market with the majority of trading conducted by brokers.

Most Sukuk are not listed with only 32 out of 520 sukuk issued in the first nine months of 2013 being listed on exchanges, a number little changed from 2012. These numbers are slightly skewed because many of the 520 sukuk were re-issued throughout the year as they were short-term issuances (so four issuances may refer to the same base issuer) and some sukuk such as Salam and Murabaha (except in Malaysia) are not tradable, hence no point in having them listed for secondary market purposes.

Of the Sukuk listed, the majority tend to be from Gulf issuers who for regulatory requirements typically dual list, with one listing in their domestic market and one listing in the European Union. The LSE used to be the default venue for such European listings, but no more, the new home is the ISE.

LSE’s Sukuk Market – Expensive with little Secondary Market

LSE’s traditional strength has been its deep pools of capital and its prestigious name inspiring trust and investor confidence in its listed securities. These strengths come at a price with the LSE being one of the more expensive locations for issuers to be listed.

In the case of Sukuk, LSE’s deep pools of capital appear to have little value, as all listed Sukuk are fully subscribed (indeed always oversubscribed) in the Primary market. As with Bonds, Sukuk are listed in order to create a secondary market, but looking at LSE’s published data, secondary trading volume of Sukuk is very thin.

Taking the example of two Sukuk listed on the LSE we see tiny amounts of secondary market activity through the exchange.

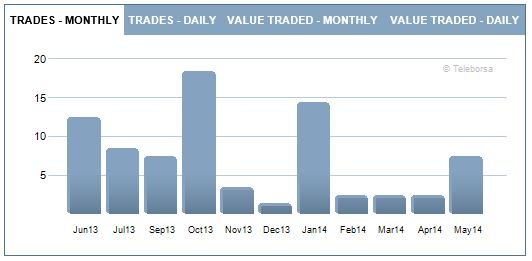

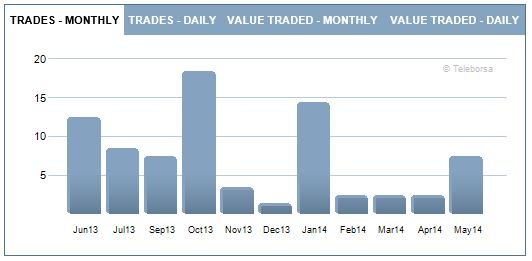

Qatar 2023, a Sovereign Sukuk issued by the Government of Qatar has had no more than 70 trades through the LSE from June 2013 to May 2014.

Chart from LSE showing monthly trades for Qatar 2023 Sukuk

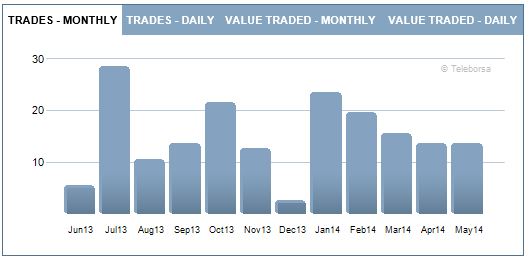

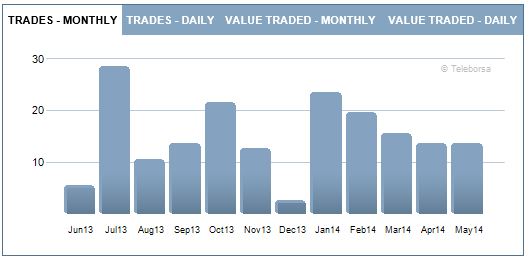

DP World 2017, a Sukuk issued by Dubai based DP World has had no more than 180 trades through the LSE from June 2013 to May 2014

Chart from LSE showing monthly trades for DP World 2017 Sukuk

These numbers do not represent the total number of trades for the Sukuk in question, as more OTC trading would have occurred directly through brokers as opposed to through the exchange. Secondary market trading through LSE is a tiny amount; issuers are finding it hard to justify the high cost of listing on the LSE.

How the Irish Stock Exchange stole a march on London

The ISE has been busy building its business in the Gulf since listing its first sukuk in 2005. It offers a “relatively inexpensive” and timely listing process, Micheál Smith, a director of IDA Ireland, said in an interview from 2012.

The ISE was the most popular global exchange for listed Sukuk in 2013 with 15 Sukuk being listed on it, and in 2014 it has listed DIP (Dubai Investments Park) Development 2019, Turkiye Finans Sukuk 2019, DAMAC 2019 and Investment Corporation of Dubai (ICD) 2020 compared with the LSE’s single listing for Islamic Development Bank 2019.

In an interview with Sukuk.com, Gerard Scully, Director of International Primary Markets at the ISE said, “The ISE has been building its listing business in the Gulf region over the last five years. This embraces both Sukuk and conventional financing. The ISE is the leading global exchange for the listing of structured bonds, so it is a natural venue for the listing of Sukuk product. Our success in this area is built upon efficient process and responsive customer service.” Mr Scully added “The ISE will continue to promote its listing services in Gulf and other regions, for both Sukuk and conventional financing. Our success in this area is reflective of our strong track record and reputation in the region. We hope to build upon that strong reputation in the future.”

One important point to note is that the listings on the ISE unlike those on the LSE are technical listings, meaning no secondary market trading occurs through the exchange. “Any trading in the underlying securities are carried out on an over the counter basis off the exchange” said Mr Scully.

Technical listings allow securities to be listed without being traded on an Exchange, and given that very little secondary market trading occurs in any case on the LSE, access to such exchange trading is rather mute, when the market prefers the OTC model.

The LSE did not respond to questions from Sukuk.com in relation to this article.